Student loans are currently one of the biggest financial burdens for young people trying to start their lives.

Not only is this a huge burden on the young graduates but it is also a problem for those who are trying to find good jobs.

This is causing people to search for how to short student loan debt. Lest discover more details in this guide.

Is it possible to Short Student Loan Debt?

It is possible to short a student loan debt if well done. There are a couple of ways to do this. Let’s say you have a 10-year loan with a 6 percent interest rate. You can take out another loan to pay off the first one. And then you can pay off that new loan within a year or two.

Problems with Shorting Student Loans

The problem is that there are some catches. First of all, you will be charged more for the new loan due to the higher interest rates.

Secondly, if you choose to go with this method, you must make your payments on time and on schedule consistently so as not to ruin your credit score in the process.

Specifically, we refer to this as trading up your debt. It works in reverse as well. If you have an older loan with lower interest rates and want to consolidate it, then this would be considered as trading down your debt.

You cannot get out of paying your loans just by getting into another type of debt or by taking out new loans and transferring them to someone else.

Most importantly, if you took out student loans and you want to avoid paying them back, you need to look at other options such as consolidation and income-based repayment plans that can help you avoid defaulting on your loans and get back on your feet financially.

How to Short or Reduce Student Loan Debt

1. Stay Away from Private Lenders

Private lenders offer higher loan amounts than federal programs but tend to have much more stringent qualification requirements.

If you cannot prove financial stability, you will not be approved.

2. Pay Extra Each Month

It is important to stay on top of your loan payments no matter what type of loan you have.

You should also try to pay more than the minimum amount every month if possible because this will significantly decrease the total time it takes for you to pay off the entire loan balance.

3. Consider Flexible Repayment Options

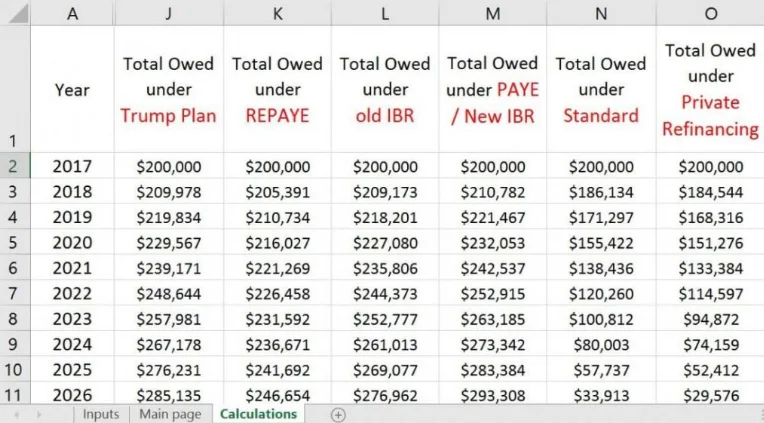

Some students use income-based repayment plans that adjust their monthly payments based on their annual income or family size instead of sticking with a set amount each month.

How to Plan for Student Loan Payment

Planning for student loan payments can be overwhelming for many people as there are many factors to consider since it is not an easy task. Some of the tips to help you overcome are as follows:

Get Organized Early

The sooner you start thinking about paying for school, the more likely you will find a way to do it. Even if it means working part-time or going to a less expensive college.

There are some other students who get creative ijn their organization., They use the student loan for personal expenses and spend their personal finances to invest or do other income-generating activities.

Start Saving Now

Consider setting up special education savings account through your bank or credit union. Use cash or a debit card to feel real and go faster.

Almost every financial institution offers an account like this, which has tax advantages and sometimes matches funds from employers.

Set aside as much as possible every month until you graduate.

If you can afford to contribute $50 a month, that will add up to $6,000 by graduation day.

Treat Student Loans Like any other Debt

If you already have student loan debt, prioritize your payments along with any other debts you have – gym memberships, rent, or car payments – to avoid delinquency charges and penalties.

FAQs

Can you negotiate your student loan debt?

It is certainly possible to negotiate your student loan debt. The first thing you should try is to call the collection agency that has been assigned to your account. To do this, you will need to find out who the collection agency is collecting on the debt.

Most lenders will be willing to lower your payments and interest rates if you can prove hardship. Therefore you can negotiate. Just the same student loan may show closed status and still get followed up through negotiation.

How can I get rid of student loan debt fast?

One of the best things you can do is earn more. You can put that money toward a debt payoff plan for your student loans. Another option is to refinance your student loans at a lower interest rate and longer.

You will need to find a job that pays well and is flexible enough for you to work your side gig on top of your main job. It may also be helpful to move somewhere with lower living expenses so you can have more money after your bills are paid.

Do student loans go away after ten years?

The lender can discharge depending on the type of loan and when you received it.

According to the U.S. Department of Education, federal student loans are eligible to be discharged – or forgiven – after a borrower makes 120 on-time monthly payments. These loans include Stafford Loans and Direct Loans.